Jul. 30, 2024

Record Purchase Tax

You can now record purchase tax when logging expenses, giving you greater control over your financials. You have the option to track purchase tax on bid requests, vendor orders, and vendor bills and expenses. For US-based contractors, you can record Non-Recoverable taxes, which are treated as job costs and distributed across taxable items in your job budget. Contractors in countries with VAT, GST, or HST can also log Recoverable taxes, which can be credited back and are not treated as job costs. By default, purchase tax recording is turned off, but you can easily enable it by editing your document templates. Here's to comprehensive tax management tailored to your business needs!

Free Construction Business E-book

10 Strategies for Construction Business Owners Aiming to Grow and Endure

Home Builders

Remodelers

Pool Builders

And More!

Let's elevate your company to new levels of success.

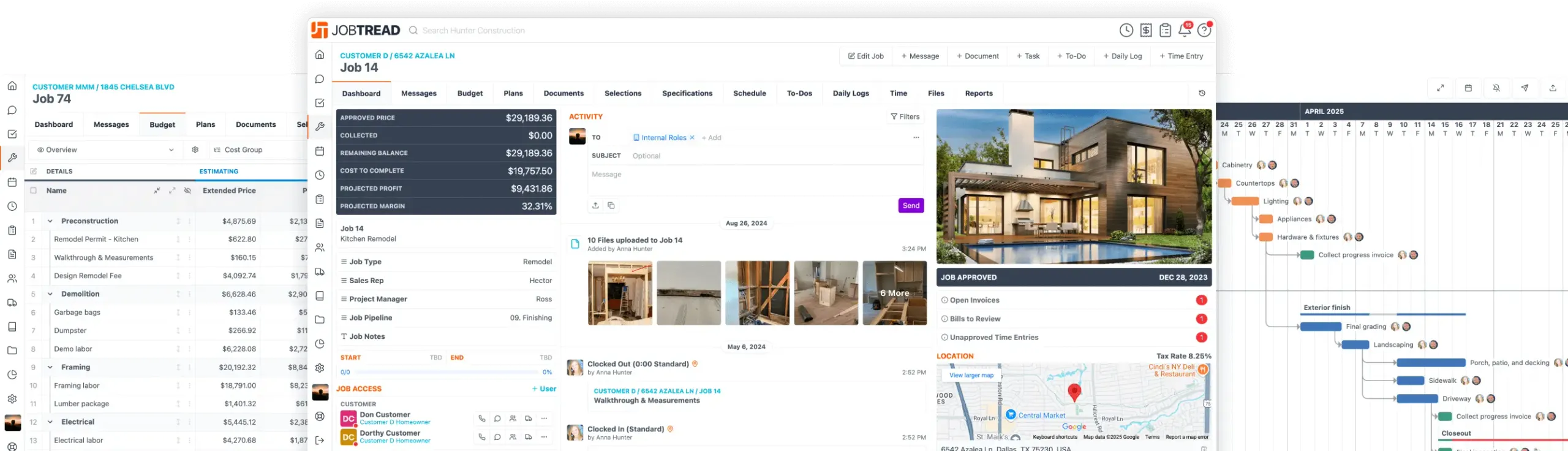

See how JobTread will get you organized, save you time, and increase your profits.

Sign Up Today